3D Secure (3DS) requires customers to complete an additional verification step with the card issuer when paying for extra fraud protection. Typically, you direct the customer to an authentication page on their bank’s website, and they enter a password associated with the card or a code sent to their phone. This process is familiar to customers through the card networks’ brand names, such as Visa Secure and Mastercard Identity Check.

The Strong Customer Authentication regulation in Europe requires 3DS for card payments.

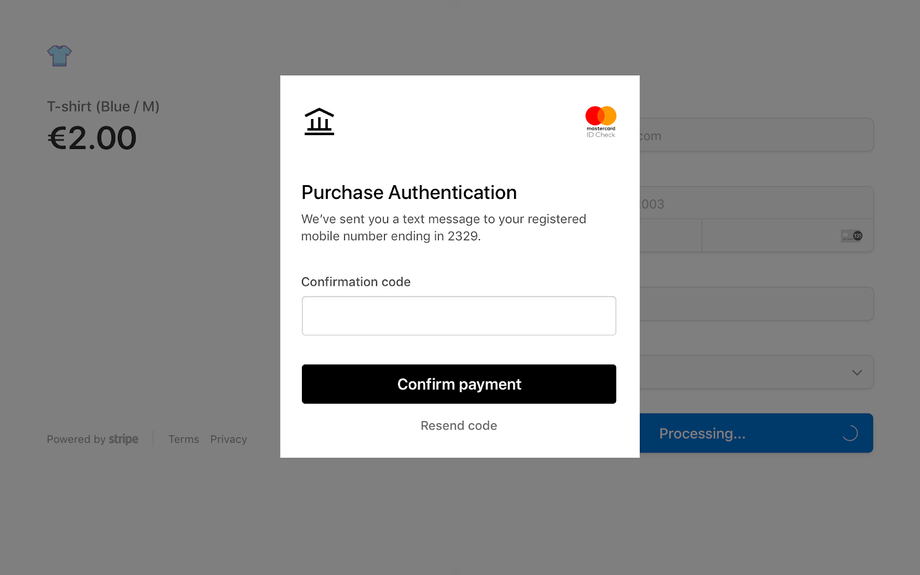

How this will look on a Desktop Browser:

Step 1: The customer enters their card details.

Step 2: The customer’s bank assesses the transaction and can complete 3D Secure at this step.

Step 3: If required by their bank, the customer completes an additional authentication step.

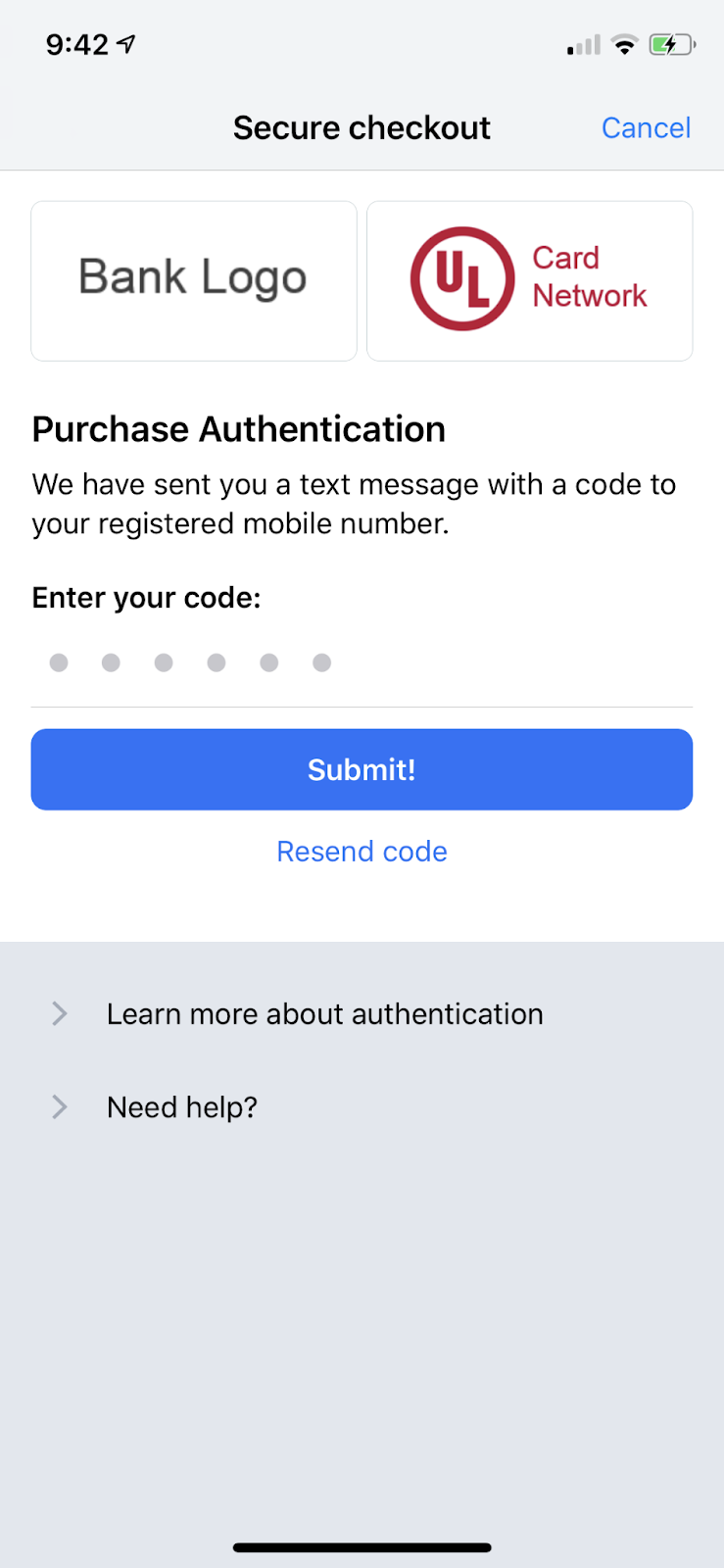

How this will look on an IOS Device:

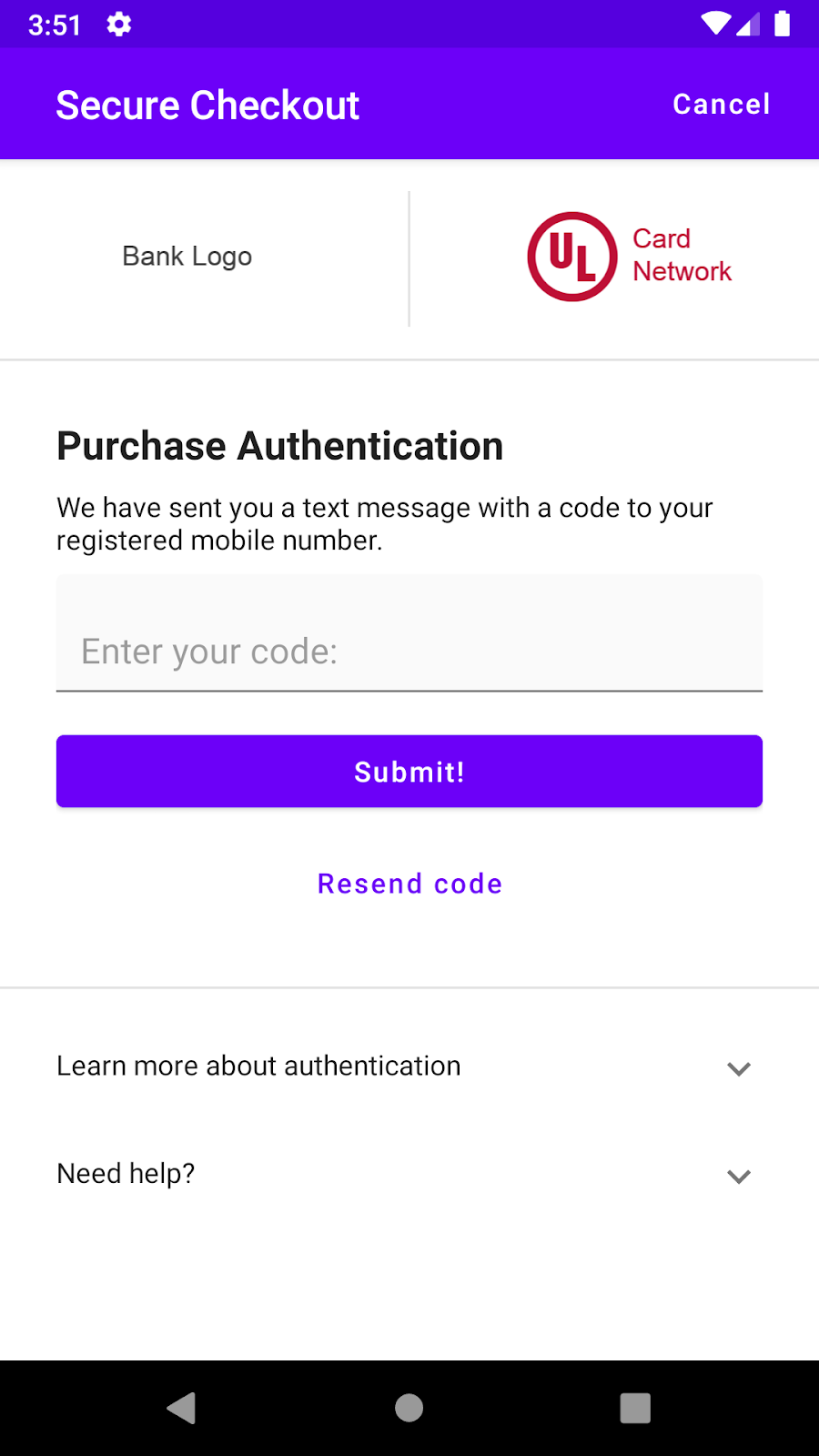

How it will look on an Android Device: